Many distributors and project contractors make the same costly mistake: Using residential flooring standards for commercial projects.

At first glance, flooring may look similar. But in real commercial use—hotels, offices, hospitals, healthcare, retail chains, education—the performance gap causes serious problems.

To make the right decision, it is essential to understand how residential and commercial spaces behave differently, and here are 5 critical differences you must bear in mind before importing or supplying flooring for commercial projects.

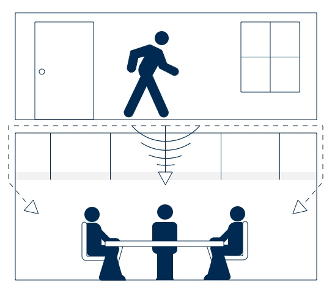

- Expansion Gap

SPC flooring is a floating system, which means it naturally expands depending on temperature and humidity changes. For this reason, SPC always requires expansion gaps around the perimeter.

In small, indoor residential spaces—typically under 20m²— this movement is controlled and predictable. Combined with built-in underlayment padding, SPC provides better sound reduction, softer foot feel, and faster installation, making it ideal for apartments and homes.

However, in larger and open commercial spaces, accumulated expansion pressure can stress joints and cause locking failure over time. As a result, SPC is not recommended for large or open commercial areas.

But for flooring distributors who still want the sound absorption and walking comfort, LVT with IXPE padding is perfectly suitable. An Cuong has developed commercial-grade LVT with IXPE underlayment, combining the long-term stability of glue-down installation with enhanced sound insulation. This allows distributors to offer LVT solutions that meet both performance and comfort expectations in offices, hotels, and public buildings—without compromising structural reliability.

2. Installation Stability

While SPC flooring is preferred for residential use due to its fast, floating installation; commercial projects would need the long-term stability of glue-down LVT.

By bonding directly to the subfloor, glue-down LVT doesn’t require expansion gaps, which makes it more reliable for high-traffic areas. This permanent bond is durable for dense traffic and prevents the click-locking breakage often seen in SPC floors.

But for those who find installing LVT Glue Down difficult, maybe LVT Peel & Stick is a smarter choice. This solution from An Cuong would maintain the same durable construction and material quality as our standard LVT, while simplifying installation and reducing labor time—especially suitable for renovation projects or fast-track commercial spaces.

3. Cleaning & Maintenance cost

Click-lock systems in SPC can weaken under frequent cleaning, moisture, and chemical exposure, increasing the risk of joint damage in case of incorrect maintenance.

On the other hand, glue-down LVT without click systems is easier to clean, more resistant to moisture intrusion, perform better with underfloor heating and far less likely to fail. Over time, this saves significant maintenance effort and cost—an important factor for commercial operators.

4. Importing price

SPC is thicker, so it typically comes with a higher import cost. In commercial projects, this added thickness doesn’t translate into better performance. Meanwhile, glue-down LVT not only performs more reliably under heavy traffic, but is also more economical—both in initial investment and long-term maintenance.

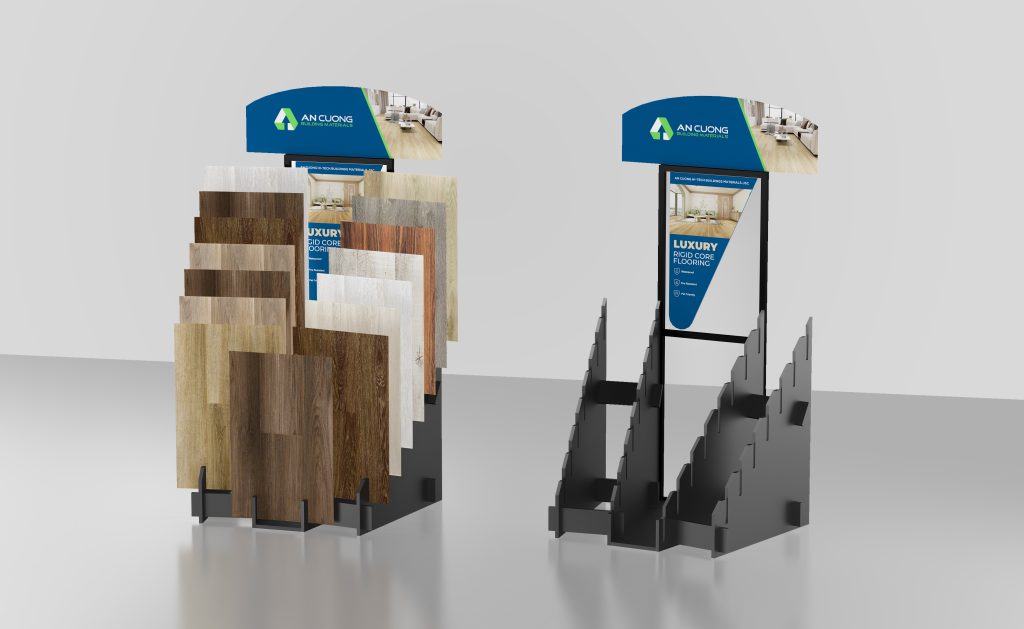

Reasonable price, extraordinary durable and flexible. This is what makes An Cuong LVT Flooring stand out from other manufactures’ LVT products.

Our LVT is engineered with a carefully balanced mix of premium PVC, optimized stone powder ratios, and strict quality control delivers outstanding durability and flexibility

At An Cuong, we take pride in supplying commercial-grade LVT to flooring distributors worldwide, meeting the most stringent performance requirements across different markets.

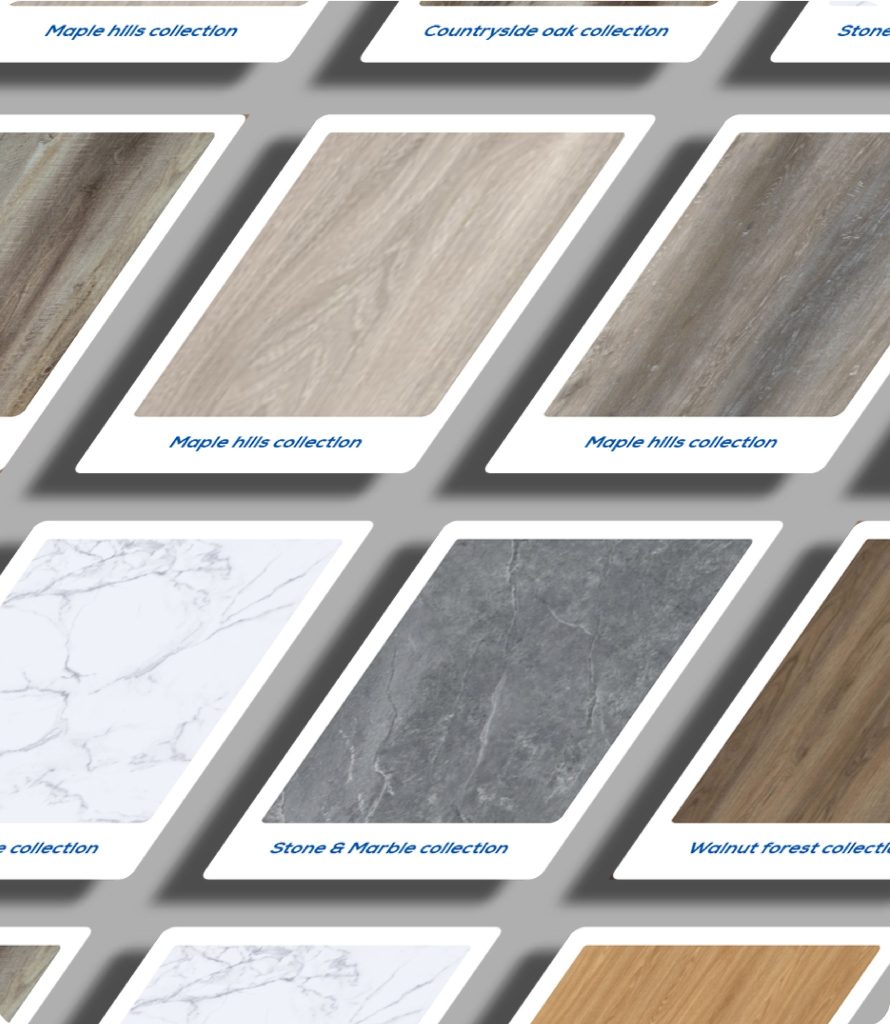

Explore the detailed technical data sheet for our SPC and LVT Flooring for each market here

Contact An Cuong today to receive a competitive competitive price, free quotation, and LVT samples tailored to your commercial project.

Here’s a summarized guide on which floors you should choose for your projects

| Criteria | SPC Flooring (Recommend for Residential project) | LVT Flooring (Recommend for Commercial project) |

| Performance |

|

|

| Installation method | Click-locking system | using LVT Glue / LVT Peel & Stick |

| Cleaning & Maintenance | More difficult because of click-locking system | Easier |

| Price | Thicker -> Higher | Thinner but more durable –> more economical |